According to GlobeNewswire, the global IoT insurance market was valued at USD 15.09 billion in 2023. It is expected to reach USD 152.76 billion by 2032, with a CAGR of 29.4% from 2024 to 2032. This growth shows that IoT is no longer an option. It is the future of insurance.

Table of contents

-

What is IoT in insurance?

-

Real-life use cases of IoT across insurance types

-

Benefits of using IoT for insurers and policyholders

-

Challenges of using IoT in the insurance industry

-

The future of IoT in insurance

What is IoT in insurance?

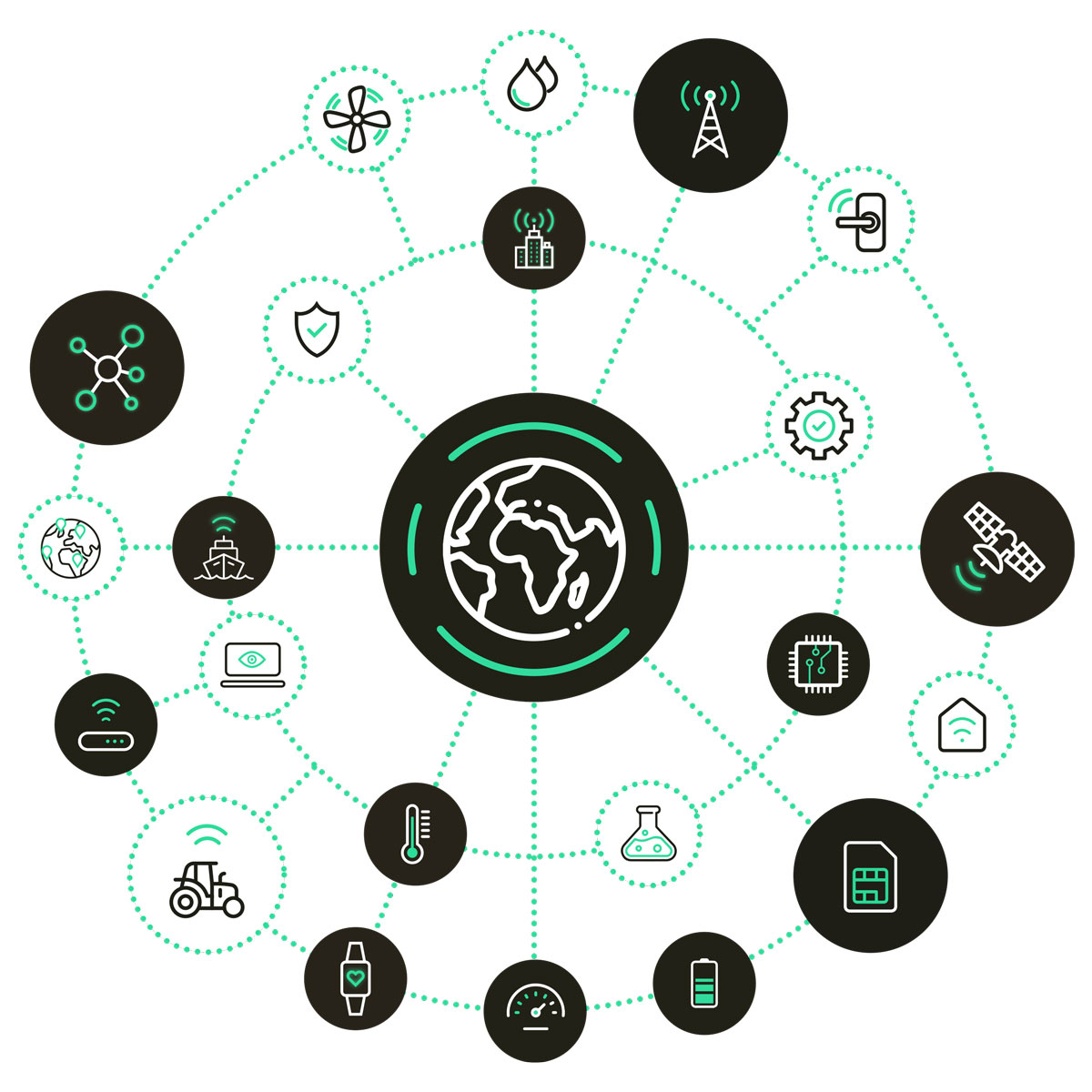

IoT in insurance means using connected devices, sensors, and networks to collect and share data between policyholders and insurers. Examples include telematics in cars, smart home systems, fitness trackers, and industrial sensors.

These devices give insurers insights into customer behaviour, property conditions, and risk levels. Insurers can then create fairer policies, stop fraud, and settle claims quickly. With global IoT SIM cards and global connectivity services, Com4 ensures this data flows securely across regions.

Real-life use cases of IoT across insurance types

IoT is changing how insurers interact with customers across every type of policy. From cars and homes to farms and cargo ships, connected devices provide real-time data that helps insurers predict risks and prevent losses. These examples show how IoT makes insurance more accurate, faster, and customer-friendly.

- Auto insurance: Telematics devices monitor driving speed, braking, and mileage. Insurers reward safe drivers with lower premiums and detect accidents instantly to confirm claims without delays.

- Health insurance: Wearables like smartwatches track heart rate, sleep, and exercise. Insurers design wellness programmes and reward healthy habits while encouraging preventive care.

- Home insurance: Smart smoke detectors, leak sensors, and cameras protect homes from fire, water damage, and theft. Customers installing these devices often enjoy reduced premiums.

- Commercial property insurance: Sensors in factories track equipment and workplace safety, predicting breakdowns before they happen to avoid costly claims.

- Agricultural insurance: IoT measures soil quality, crop health, and weather conditions. Insurers assess risks of drought, floods, or crop failure with greater accuracy.

- Travel insurance: Smart tags and trackers monitor luggage during travel. Real-time updates help insurers process lost baggage claims faster.

- Marine and cargo insurance: IoT sensors track shipments, monitoring conditions like temperature, humidity, and tampering to verify losses.

- Life insurance: Wearables capture lifestyle and health data. Insurers use this information to build customised policies and reward healthier habits.

- Pet insurance: Smart collars track pet activity, location, and health, supporting accurate coverage and early detection of issues.

Benefits of using IoT for insurers and policyholders

The advantages of IoT in insurance go far beyond lower premiums. Insurers gain precise risk insights, while customers enjoy fairer policies, faster claims, and stronger protection. Together, these benefits are creating a smarter, more efficient insurance ecosystem.

- Accurate risk assessment: IoT devices provide real-time insights into customer behaviour and conditions, leading to fairer risk profiles and stronger trust.

- Personalised premiums: Safe drivers, active individuals, and secure homeowners benefit directly from behaviour-based pricing.

- Fraud detection: Telematics and smart devices verify events, making false claims harder to sustain.

- Faster claims processing: Real-time data speeds up investigations and reduces paperwork, creating smoother customer experiences.

- Preventive maintenance: Alerts from IoT devices help stop small problems before they escalate into costly claims.

- Improved customer experience: Real-time updates, tailored policies, and transparency increase satisfaction and loyalty.

- Cost efficiency for insurers: Lower fraud and fewer disputes reduce operational costs and enable more competitive premiums.

- Global coverage and connectivity: IoT ensures seamless cross-border service and efficient data flow for international policyholders.

- Safer communities: Healthier lifestyles, safer driving, and secure homes contribute to broader societal safety.

- Innovation and competitive advantage: IoT supports creative products like pay-as-you-go or wellness-based policies, helping insurers stand out.

Challenges of using IoT in the insurance industry

While IoT offers huge opportunities, it also brings challenges that insurers must address. Issues like privacy, cybersecurity, and implementation costs can slow adoption if not managed carefully.

- Data privacy concerns: Customers need transparency about how their data is collected, stored, and used.

- Cybersecurity risks: Devices must be secured against hacking to protect sensitive information.

- High implementation costs: Smaller insurers may struggle with the expense of deploying IoT systems.

- Data overload: Advanced tools are needed to process and analyse massive amounts of IoT data.

- Regulatory compliance: Insurers must follow diverse data laws across regions, adding complexity.

- Customer trust: Some policyholders hesitate to share personal data, requiring clear assurances.

- Device reliability: Faulty or inaccurate devices can create risks for insurers and customers alike.

- Dependence on connectivity: Strong networks are essential for IoT, and remote areas still face challenges.

The future of IoT in insurance

The IoT insurance market is set for rapid expansion, growing from USD 15.09 billion in 2023 to USD 152.76 billion by 2032. This surge proves IoT is central to the future of insurance. With connected devices generating constant data, insurers will gain deeper insights into risks and behaviours, making policies fairer and more flexible.

AI and blockchain will further improve accuracy, speed up processes, and enhance transparency in claims. Pay-as-you-go insurance models will become common, fraud detection will strengthen, and insurers will expand globally with seamless connectivity solutions.

IoT will eventually extend into cities and infrastructure. Predictive healthcare will identify risks before they become serious, while smart cities will reduce incidents across transport and energy systems. Insurers adopting IoT will not only cut costs but also help build safer, healthier, and more resilient societies.

IoT is transforming insurance by making policies fairer, claims faster, and risks easier to manage. While challenges like privacy and costs exist, the opportunities are far greater. Insurers who embrace IoT today will lead tomorrow’s market. With secure and scalable solutions like those from Com4, insurers can deliver innovative products that meet customer needs worldwide.

FAQs on IoT in insurance

What is the application of IoT in insurance companies?

IoT helps insurers collect real-time data through devices like telematics, wearables, and smart sensors. This information allows insurers to predict risks more accurately and offer fairer pricing. For example, auto insurers can price premiums based on actual driving behaviour rather than assumptions.

Are IoT-based insurance policies more expensive?

What are the privacy risks of IoT in insurance?

The main risk lies in handling sensitive data. Strong encryption, secure networks, and compliance with laws are vital to protect customers.

Can IoT improve health insurance?

How does IoT help with auto insurance?

Telematics track driving habits, allowing safer drivers to prove their record and pay lower premiums.

Will IoT completely replace traditional insurance?

No. IoT enhances traditional insurance rather than replacing it. Human judgement and compliance remain essential, supported by IoT-driven insights.

CASE STUDY

CASE STUDY

.jpg)